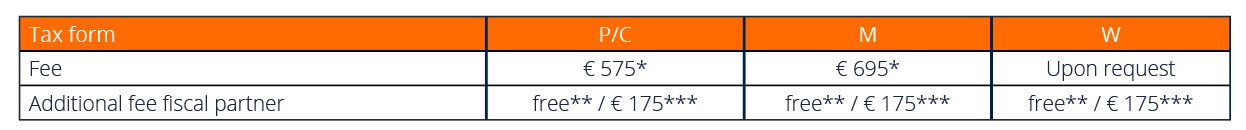

& fixed fees

January 2024

* Fee for ‘standard tax return’, i.e. simple employment, own dwelling and net wealth situation

** Fee for fiscal partner no income

*** Fee for fiscal partner with employment income only

P = resident taxpayers (not self-employed)

C = non-resident taxpayers

M = migration tax return

W = small business / sole trader

The following standard services are included in the fee:

• arranging a filing extension

• gathering information via questionnaire

• preparing the tax return

• explaining the Dutch tax position and the positions taken

• reviewing the provisional and the final assessment.

We believe in a flexible, fair and transparent billing relationship and understand that no one likes surprises. We aim to agree the

parameters of our fees before commencing any work, and we know that communication is key if unexpected complexities arise.

We can tailor your fixed fee quotes for compliance work so that our fees are appropriate to your personal circumstances, and we

bill at our hourly rates for advisory work, while working with you to set strict budget guidelines.

Our tax compliance department applies the following fixed fees for personal tax returns (excluding VAT)

* Fee for ‘standard tax return’, i.e. simple employment, own dwelling and net wealth situation

** Fee for fiscal partner no income

*** Fee for fiscal partner with employment income only

P = resident taxpayers (not self-employed)

C = non-resident taxpayers

M = migration tax return

W = small business / sole trader

The following standard services are included in the fee:

• arranging a filing extension

• gathering information via questionnaire

• preparing the tax return

• explaining the Dutch tax position and the positions taken

• reviewing the provisional and the final assessment.

W

Upon request

free**

€ 165***

M

€ 650*

free**

€ 165***

P/C

€ 550*

free**

€ 165***

Tax form

Fee

Additional

fee fiscal

Partner

We believe in a flexible, fair and transparent billing relationship and understand that no one likes surprises. We aim to agree the

parameters of our fees before commencing

any work, and we know that communication

is key if unexpected complexities arise.

We can tailor your fixed fee quotes for compliance work so that our fees are appropriate to your personal circumstances,

and we bill at our hourly rates for advisory

work, while working with you to set strict

budget guidelines.

Our tax compliance department applies the following fixed fees for personal tax returns (excluding VAT)

Services

Partner

Director

Senior manager

Manager

Junior manager

Senior adviser

Adviser

Junior tax adviser

Junior adviser

Assistant

Hourly rates

excluding VAT

€ 395

€ 375

€ 295

€ 245

€ 215

€ 195

€ 175

€ 140

€ 115

€ 75

January 2024

& fixed fees